From NTPM financial statement result, it showed a consistence result over 6 years (from year 2004 to 2009) with average ROE 18%.

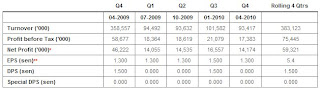

From the above financial statement,

But like this type of company, competition is very fierce, so the cost management must be good. So far NTPM is still doing a good job on that. I believe NTPM is a good company to invest in long term basic but however the return of your investment is depending on the price you invest.

For the current price 58.5 cents with last quarter result 1.3 cents, which give PE 11.25

- Revenue is growing getting faster from 7.5% (2005) to 17.1% (2009)

- Advertising expenses maintain at 2%

- Raw materials & consumables used maintain around 36.3% to 38.8%

- Repairs & Maintainance expenses slightly increase from 2.9% (year 2004) to 3.3% (2009)

- Employee benefits expense is getting less with 16.7% (2004) to 15.2% (2009)

- Sundry wages maintain at 0.6%

- transportation and freight charges maintain around 5.8% to 6.4%

- Utilities Costs maintain at around 6.3% to 6.6%

- Financial Costs reduce from 1.1% (2005) to 0.6% (2009)

From the above financial statement,

- We can see that Raw Materials costs, Transportation cost and utilities costs are maintained at at flat percentage, which means NTPM has the power to pass the cost to the customer.

- Revenue grow means its market is getting bigger.

- Employee expenses and financial costs are getting less means the management is very efficiency and able to use well in manpower.

But like this type of company, competition is very fierce, so the cost management must be good. So far NTPM is still doing a good job on that. I believe NTPM is a good company to invest in long term basic but however the return of your investment is depending on the price you invest.

For the current price 58.5 cents with last quarter result 1.3 cents, which give PE 11.25

No comments:

Post a Comment